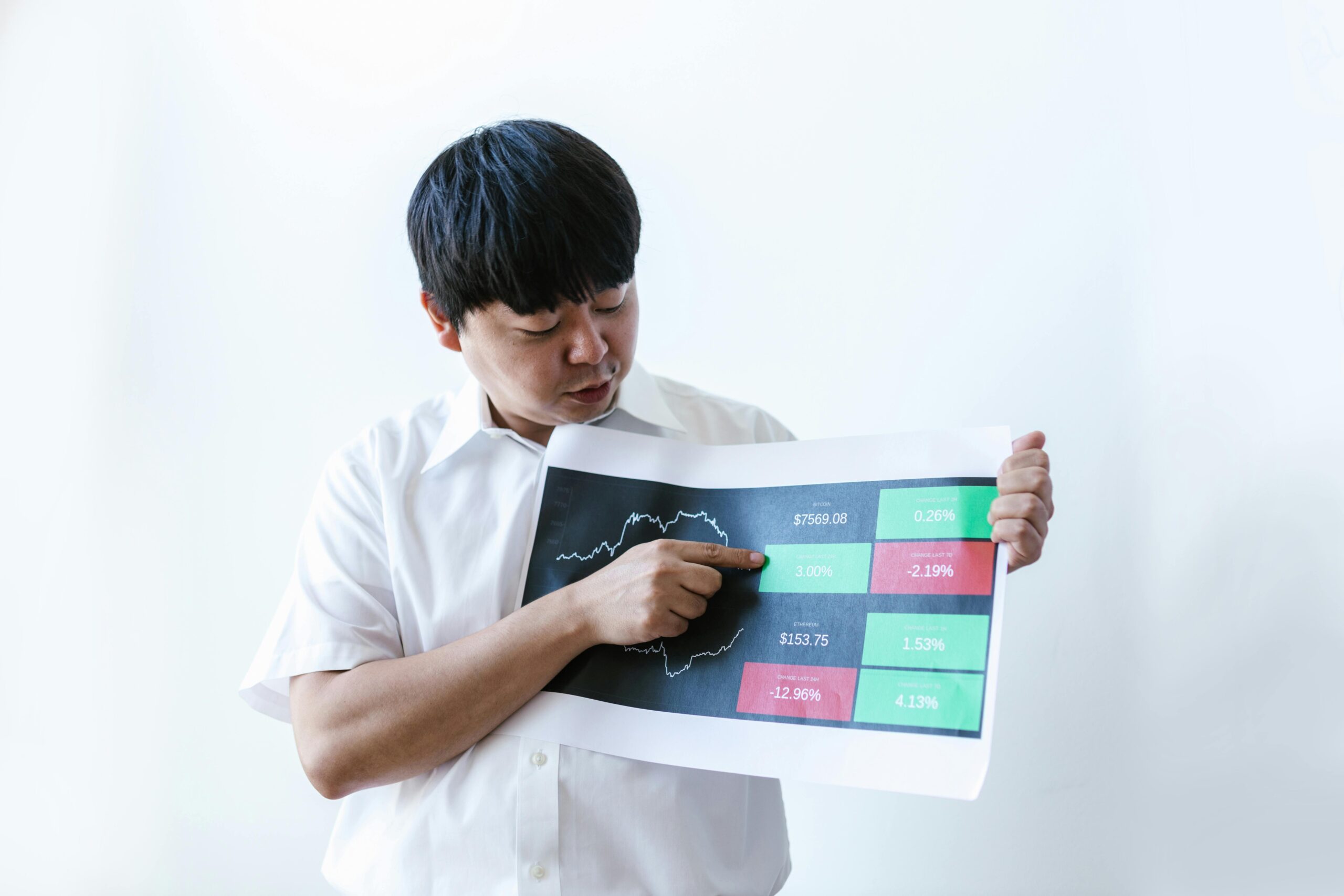

Startups often face challenges in managing their financial operations efficiently. By leveraging BI-driven insights to streamline finance in startups, businesses can gain a competitive edge, optimize cash flow, and enhance decision-making. This article explores ten actionable steps startups can take to effectively use business intelligence (BI) tools for financial success.

What Are BI-Driven Insights?

Business Intelligence (BI) involves tools and techniques that transform raw data into meaningful information, enabling data-driven decision-making. For startups, BI-driven insights provide a clear view of financial health, predict future trends, and identify inefficiencies.

10 Steps BI-Driven Insights to Streamline Finance in Startups

1. Set Clear Financial Goals

Define measurable and achievable financial objectives. BI tools can monitor progress toward these goals, offering real-time insights into budget adherence, revenue targets, and expense tracking.

2. Centralize Financial Data

Integrate all financial data into a unified BI platform. This eliminates manual data consolidation, ensuring faster analysis and reducing errors. Centralization improves accessibility and provides a single source of truth for decision-making.

3. Implement Cash Flow Analytics

BI-driven insights help startups analyze cash flow patterns and predict future inflows and outflows. By identifying gaps in liquidity, startups can proactively plan for funding needs or cost adjustments.

4. Monitor Key Financial KPIs

Key performance indicators (KPIs) such as gross margin, burn rate, and return on investment (ROI) are critical for startups. BI tools track these KPIs in real-time, enabling prompt corrective actions.

5. Automate Financial Reporting

Manual financial reporting is time-consuming and prone to errors. BI-driven systems automate report generation, offering accurate and timely financial summaries. Automation allows startup teams to focus on strategy rather than administrative tasks.

6. Forecast with Predictive Analytics

Using predictive analytics, startups can forecast revenue, expenses, and market trends. BI tools leverage historical data to create accurate financial models, helping startups prepare for uncertainties.

7. Identify Cost-Cutting Opportunities

BI insights reveal areas where costs can be reduced without compromising quality. For instance, analyzing supplier data can uncover more cost-effective procurement options.

8. Enhance Budget Management

BI systems assist in creating and managing budgets. They provide alerts for budget overruns and identify areas where expenses deviate from expectations. Startups can allocate resources more effectively using these insights.

9. Optimize Revenue Streams

BI tools analyze revenue sources, identifying the most profitable segments. This allows startups to focus on high-performing products or services while reevaluating underperforming ones.

10. Strengthen Compliance and Risk Management

Regulatory compliance is vital for startups. BI platforms monitor financial transactions and flag irregularities, reducing the risk of fraud and ensuring adherence to legal requirements.

Benefits of Using BI-Driven Insights in Startups

- Informed Decision-Making: Real-time data enables quicker and more accurate financial decisions.

- Efficiency: Automation reduces manual tasks, saving time and resources.

- Scalability: BI systems grow with the business, accommodating increasing data complexity.

- Competitive Edge: Data-driven strategies position startups ahead of competitors.

How to Choose the Right BI Tools for Your Startup

Selecting the right BI tool is crucial for success. Look for features such as:

- User-friendly dashboards

- Scalability

- Customizable reporting

- Robust data integration capabilities

Conclusion

Leveraging BI-driven insights to streamline finance in startups is no longer optional in today’s competitive environment. From setting clear financial goals to optimizing revenue streams, BI tools provide startups with the clarity and precision needed to navigate financial complexities. Implementing these ten steps will ensure a strong financial foundation, enabling sustainable growth and long-term success.

FAQ

1. What is the role of BI in startup finance?

BI helps startups analyze and interpret financial data, enabling better budgeting, forecasting, and decision-making.

2. Are BI tools expensive for startups?

Many BI tools offer scalable pricing models, including free or affordable plans for startups.

3. Can BI tools integrate with accounting software?

Yes, most BI platforms integrate seamlessly with popular accounting software, providing a comprehensive view of financial data.

4. How quickly can a startup see results using BI-driven insights?

Results depend on the implementation and complexity of the financial challenges. However, most startups notice improvements within a few months.

5. What are the best BI tools for startups?

Popular tools include Tableau, Power BI, and Looker, which offer robust features tailored to small businesses and startups.